AI Agents That Handle Your Tax Compliance 10x Faster

We're building autonomous AI agents trained on UAE & India tax laws. India app is LIVE now! Join 537+ businesses already on our waitlist for UAE Q3 2025 launch.

The Problem is Real

67% of UAE SMEs risk penalties due to complex corporate tax requirements. Manual processes cost 40+ hours per month and $12,000+ in compliance costs. In India, GST compliance takes 30+ hours monthly with ₹50,000+ in compliance costs.

See Taxora.AI in Action

Watch how our AI agents automate complex tax workflows in minutes, not hours for both UAE & India

1. Upload Any Document

2. AI Analyzes & Categorizes

3. Get Expert Answers

AI Agent Capabilities

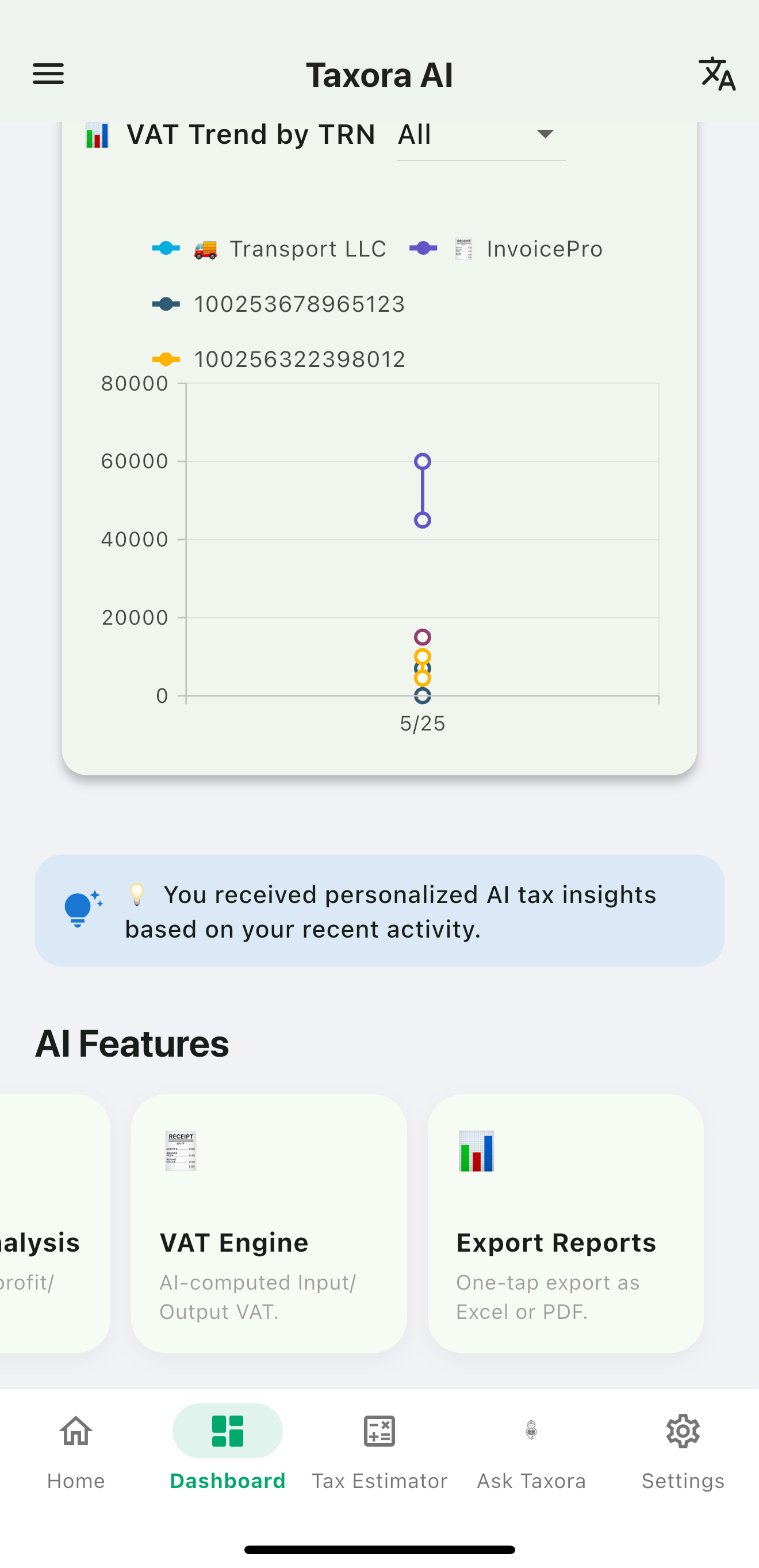

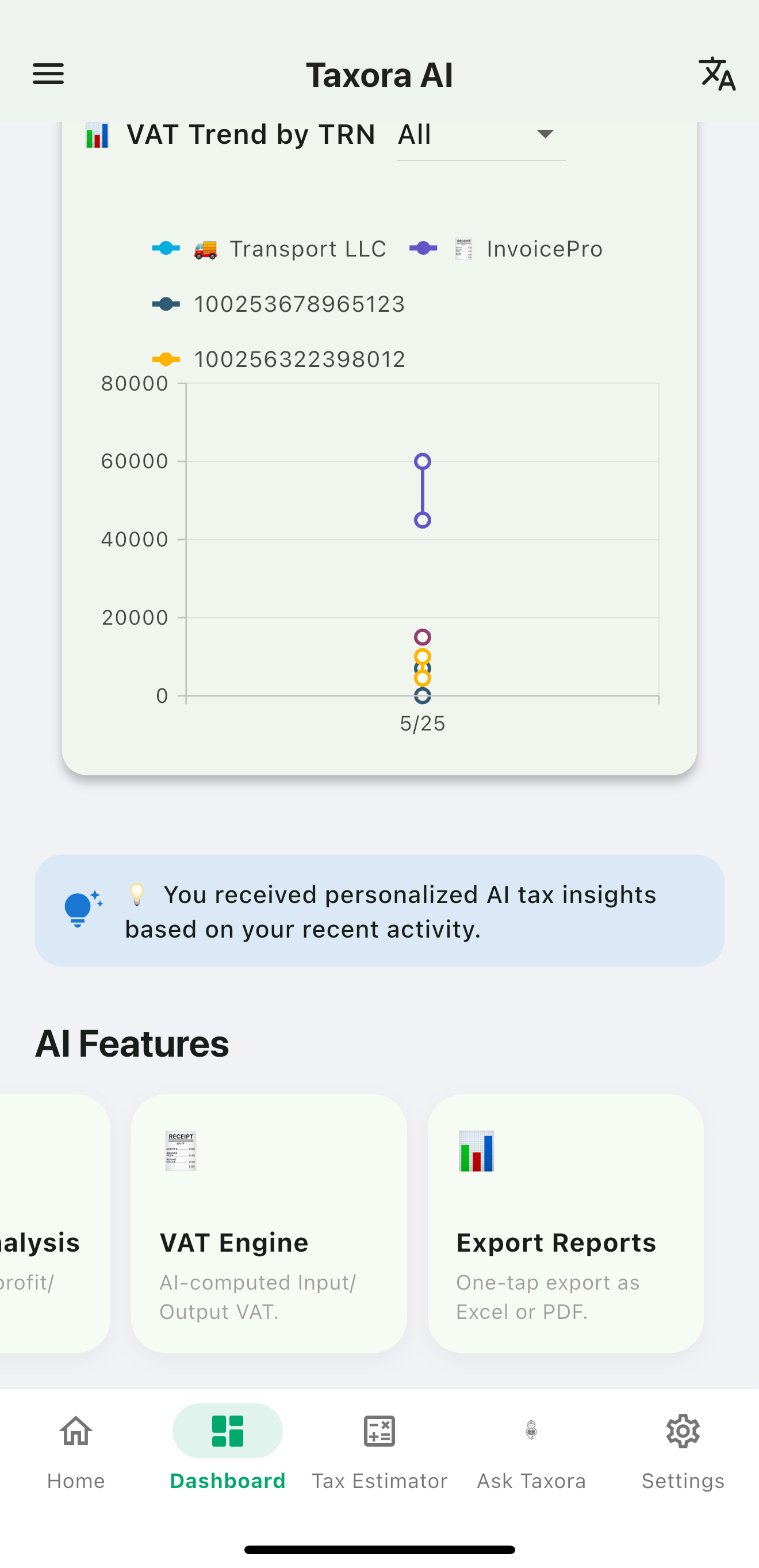

Autonomous AI agents working 24/7 to handle every aspect of your UAE & India tax and compliance operations

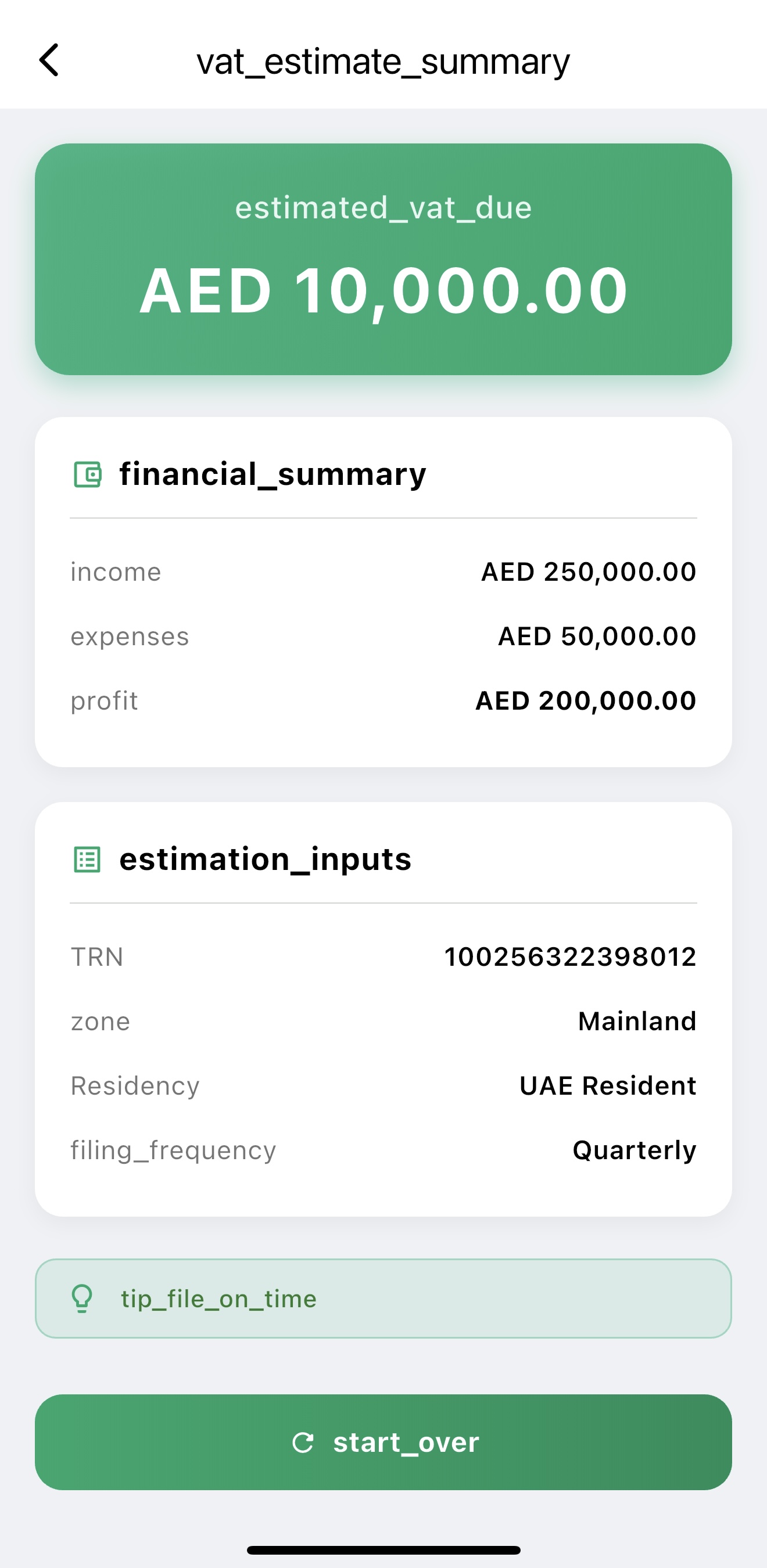

Automated Tax Filing (UAE & India)

Upload any document (PDF, image, Excel). Our AI agents instantly extract data, categorize transactions, and prepare tax-ready reports with 95%+ accuracy. 🇮🇳 India: ITR, GST, TDS filing | 🇦🇪 UAE: VAT, Corporate Tax

Real-Time Compliance Monitoring

Trained on 1000s of official FTA documents. Monitors deadlines, flags risks, ensures continuous compliance.

Intelligent Tax Planning

AI-powered dashboard provides strategic insights, identifies savings opportunities, and optimizes your tax position.

Tax Law Q&A Engine (UAE & India)

Get instant expert-level answers to complex tax questions, backed by official guidance and precedents. 🇮🇳 India: ITR, GST, TDS queries | 🇦🇪 UAE: VAT, Corporate Tax

Multi-Entity Support

Handle complex corporate structures, group companies, and cross-border transactions seamlessly.

Enterprise Integrations

Connect with your existing ERP, accounting software, and business systems via secure APIs.

🇮🇳 India Tax Specialists

ITR Filing: Automated income tax return preparation with AI validation. GST Compliance: Real-time GST filing, reconciliation & compliance monitoring. TDS Management: Automated TDS calculation, filing & certificate generation.

Reserve Your Spot

Join 537+ forward-thinking companies. Get 50% off for 6 months as an early adopter.

Simple, Transparent Pricing

Choose the plan that fits your business. Available in both UAE & India with local currency pricing.

Starter

- ✓ Up to 100 transactions/month

- ✓ Basic VAT filing

- ✓ AI tax assistant

- ✓ Email support

- ✓ 14-day free trial

Professional

- ✓ Up to 500 transactions/month

- ✓ VAT + Corporate Tax filing

- ✓ Advanced AI assistant

- ✓ Priority support

- ✓ API access

- ✓ Multi-entity support

Enterprise

- ✓ Unlimited transactions

- ✓ All tax types covered

- ✓ Custom AI training

- ✓ Dedicated support

- ✓ Advanced integrations

- ✓ White-label options

Frequently Asked Questions

When are you launching?

We're targeting Q3 2025 for our beta launch. Early access users will get in 2-3 months before public launch. The waitlist is growing fast - secure your spot now for 50% off.

How is this different from other tax software?

Traditional tax software requires manual input and human oversight. We're building autonomous AI agents that think, learn, and act independently. Our agents understand context, learn from patterns, and proactively optimize your tax strategy.

Is my data secure with Taxora.AI?

Bank-level encryption, SOC 2 Type II compliance, and zero-knowledge architecture. Your data is processed locally and encrypted at rest and in transit. We can't see your financial data even if we wanted to. Privacy isn't a feature - it's our foundation.

What makes your AI different?

Our AI agents are specifically trained on UAE & India tax legislation and official documentation. They understand nuances, precedents, and context that generic AI models miss. Plus, they're validated by certified tax professionals in both jurisdictions.

Do you support multiple jurisdictions?

Yes! We currently support India (ITR, GST, TDS) and UAE (VAT, Corporate Tax, Zakat). Expanding to GCC by Q4 2025, and global markets in 2026. Our architecture is built for multi-jurisdiction from day one.

🇮🇳 Is the India app really live?

Yes! Our India app is fully functional and live now. You can sign up today and start using ITR, GST, and TDS automation. The UAE app launches in Q3 2025, but India users get immediate access to all features.

What's your pricing model?

Usage-based pricing that scales with your business volume. Early access users get 50% off for the first 6 months. No setup fees, no hidden costs. Enterprise packages available for complex structures.

Built by Experts, Powered by AI

Taxora.AI isn't just smart algorithms. Our platform combines cutting-edge AI with deep UAE & India tax expertise. Every model is trained on official documentation and validated by certified tax professionals in both jurisdictions, ensuring accuracy, reliability, and compliance.

Security & Compliance First

We understand you're trusting us with sensitive financial data. Our platform is architected with enterprise-grade security and zero-knowledge privacy.

🔒 Bank-Level Encryption

All data encrypted with AES-256, the same standard used by leading banks and financial institutions worldwide.

🧑💼 Expert Validated

Our AI models and compliance workflows are built and continuously validated with certified UAE & India tax professionals.

🛡️ Zero-Knowledge Architecture

We process your data locally and never store sensitive information. Full GDPR and UAE data protection compliance.

Ready to Transform Your Tax Operations?

Join 537+ companies already waiting. Don't let manual tax compliance slow your growth.